While unlisted infrastructure was historically combined with other alternative assets such as real estate and private equity, several characteristics have given its distinction as a standalone asset class in a portfolio.

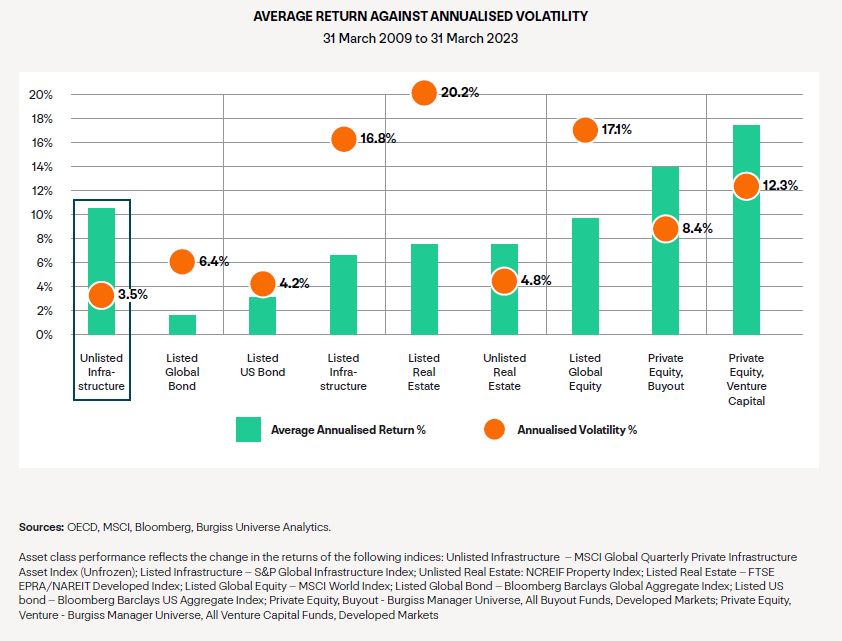

For example, as shown in the chart below, unlisted infrastructure assets have historically demonstrated lower volatility in returns than other growth asset classes.

Additionally, long holding periods, inflation protection, the monopolistic nature of essential services, and multiple sources of diversification further contribute to the recognition of the asset class as a cornerstone in the diversified portfolios of many of the world’s most sophisticated institutional investors.

This article discusses how IFM Investors defines unlisted infrastructure, describes the benefits of the asset class in a portfolio, and provides portfolio examples such as the Indiana Toll Road in the United States, the Baltic Hub DCT in Poland, and the Sydney Airport in Australia.

Related articles

View these articles

Driving out emissions: Decarbonisation of the transport sector

Enhancing the customer experience at infrastructure assets